reit dividend tax rate

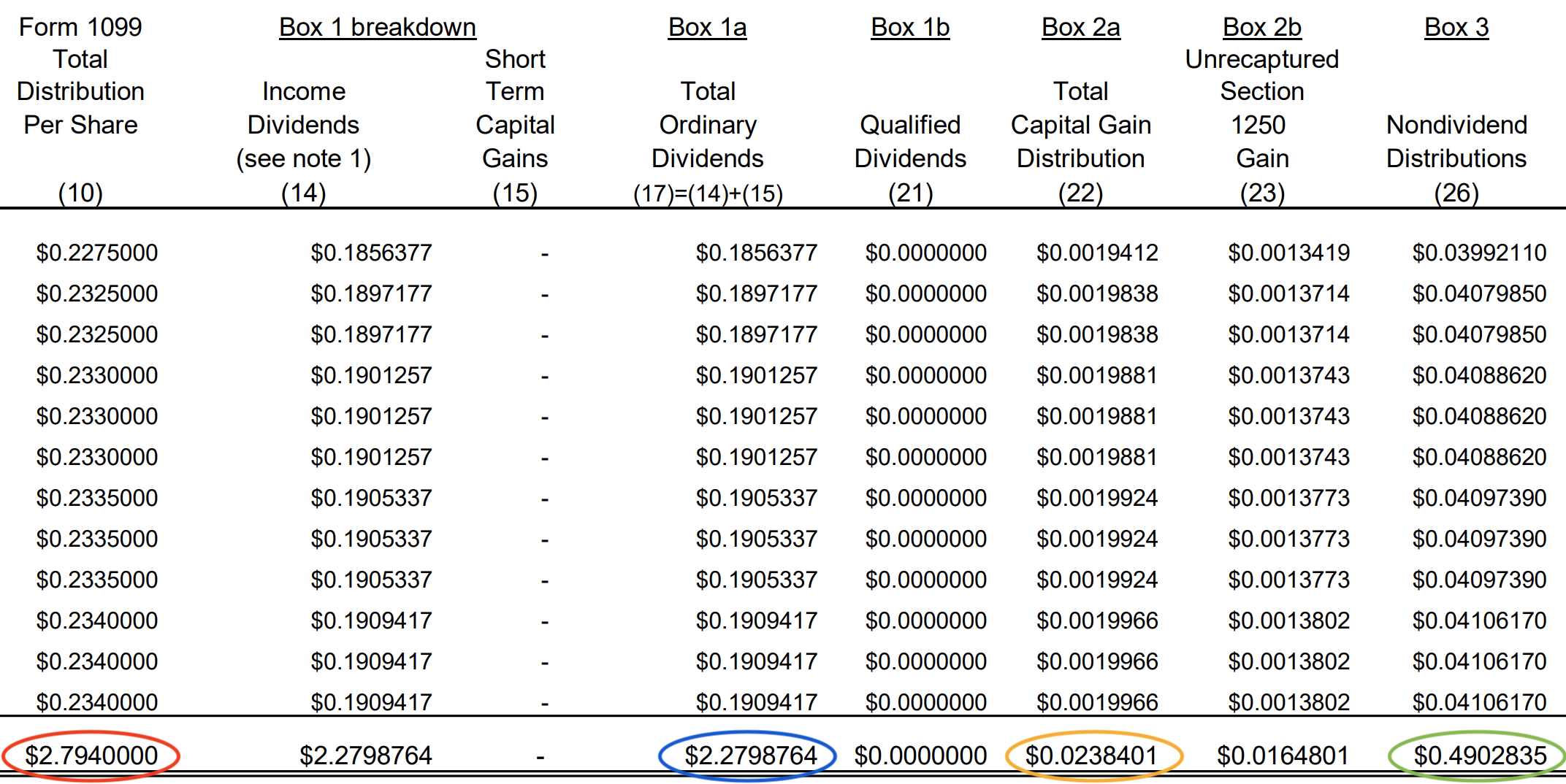

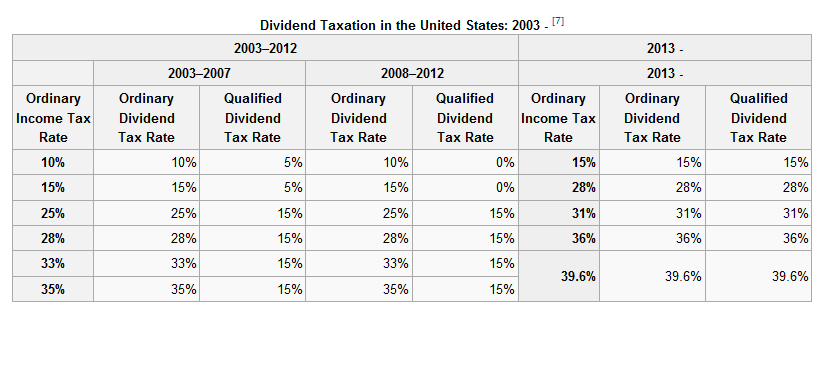

Because they can be allocated to ordinary income capital gains and return of capital REIT dividends can be taxed at various rates. 7 rows Most REIT distributions are considered non-qualified dividends which means that they do not.

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

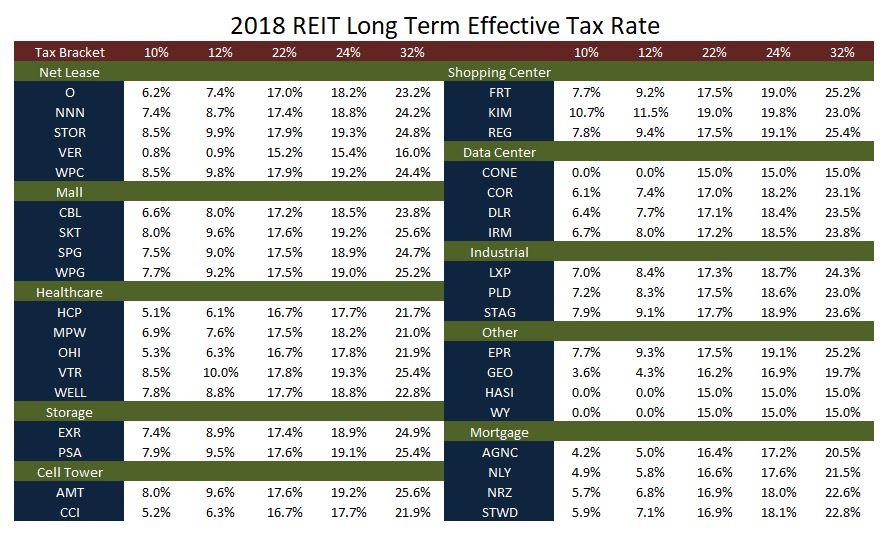

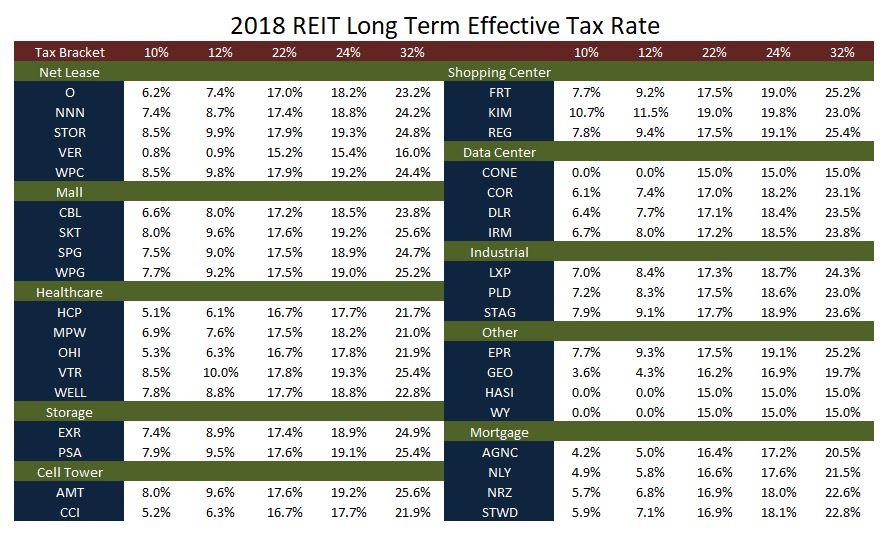

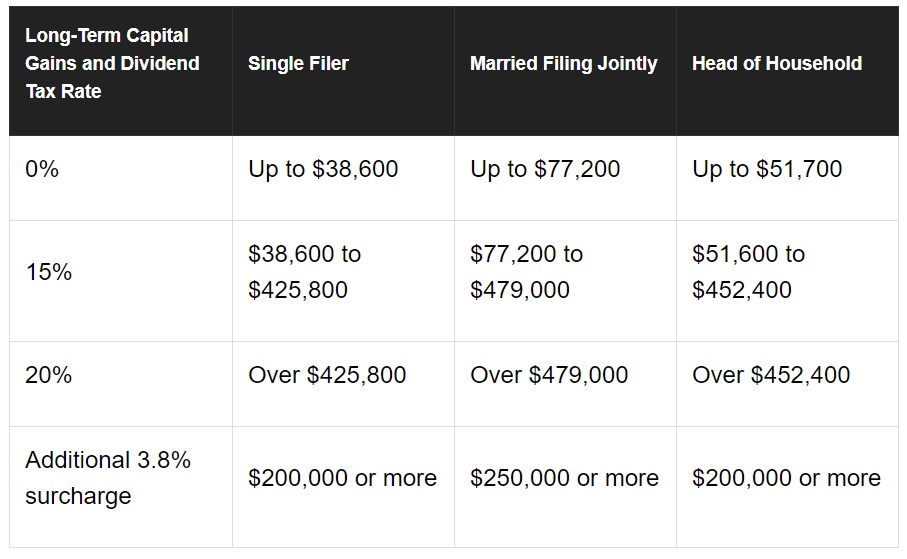

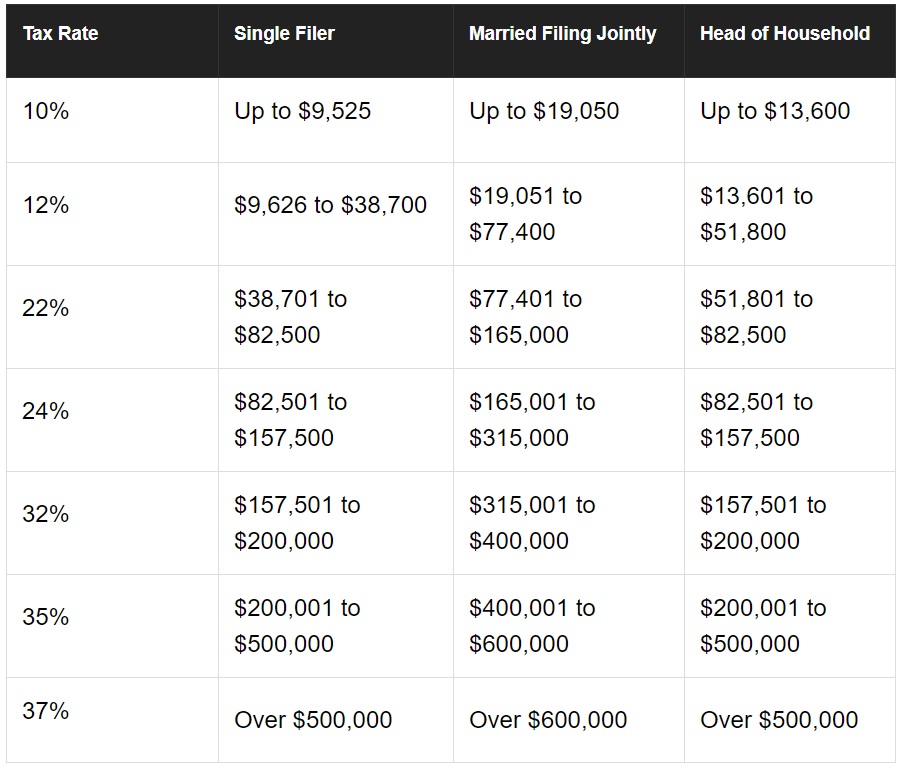

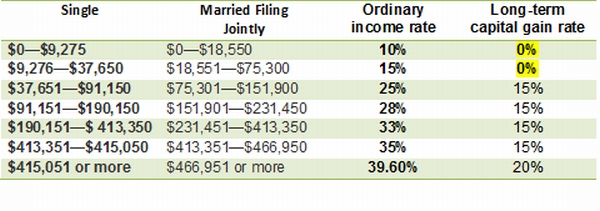

The long-term capital gains rates in the US.

. The portion of a REIT dividend classified as income may be eligible for preferential tax treatment. Are currently 0 15 or 20 depending on the taxpayers income but are always lower than the corresponding marginal tax. This provision qualified business income effectively.

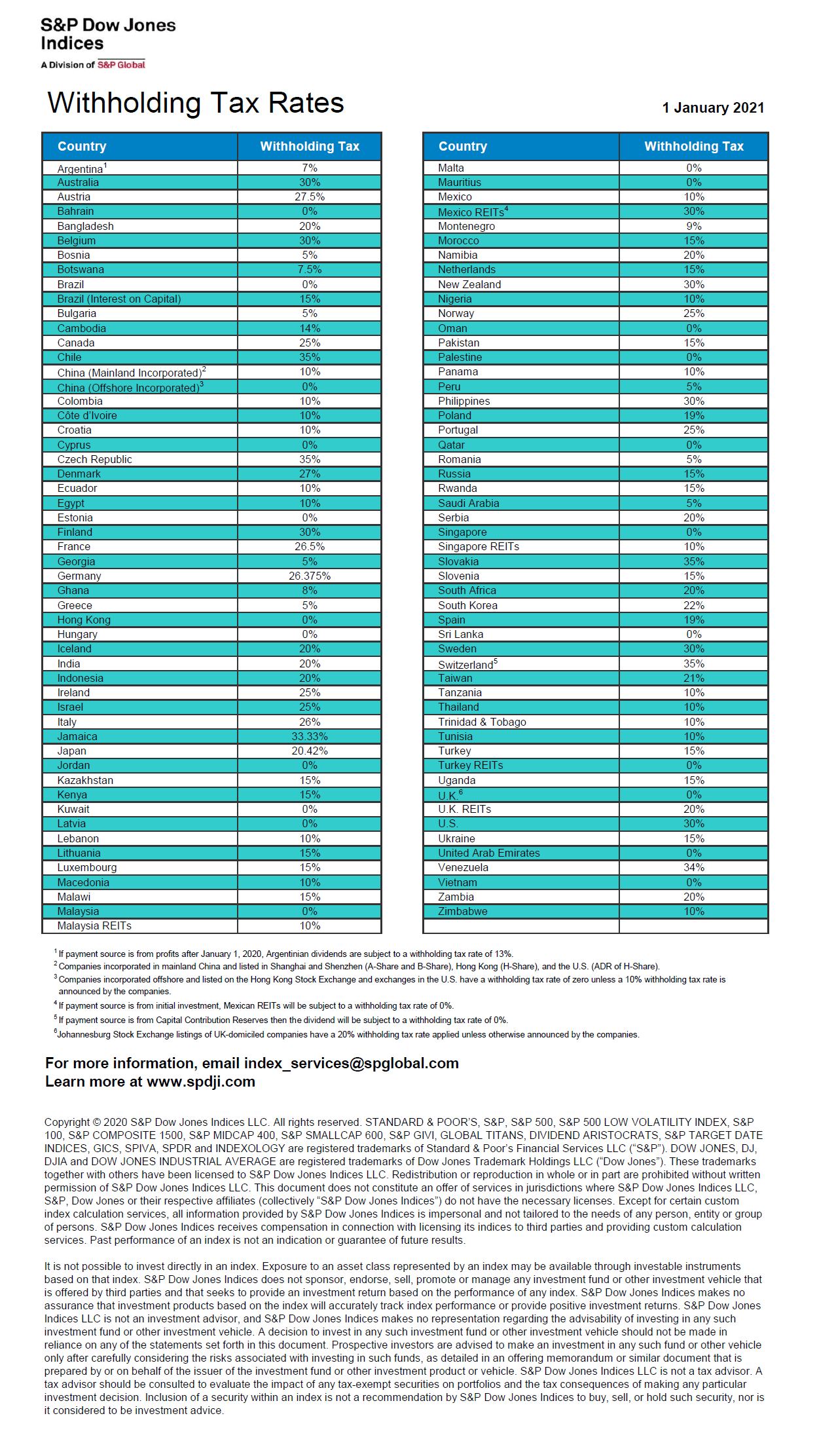

65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared. Second your REIT can also provide you with. If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20.

Let A Tax Expert Take Taxes Off Your Plate. There is no cap on the deduction no wage restriction and itemized deductions are not required to receive this benefit. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

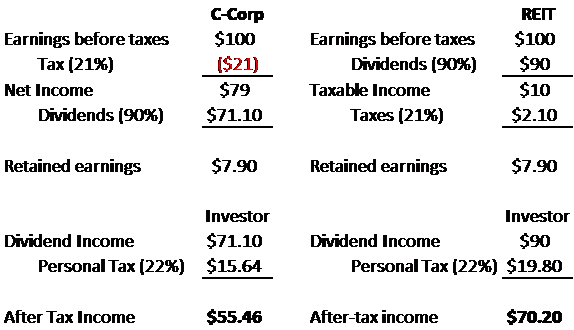

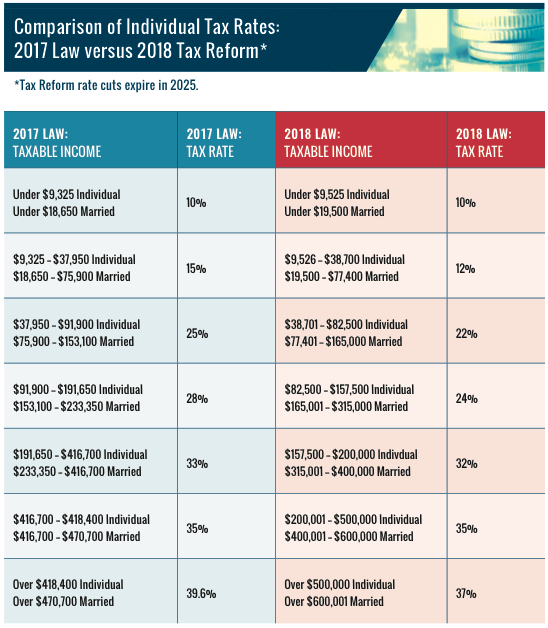

So if youre in the 24 tax bracket the IRS applies that tax rate to most dividends you receive from your. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends. In exchange for meeting certain requirements -- in particular paying at least 90 of their taxable income to shareholders as dividends -- REITs pay no corporate tax whatsoever.

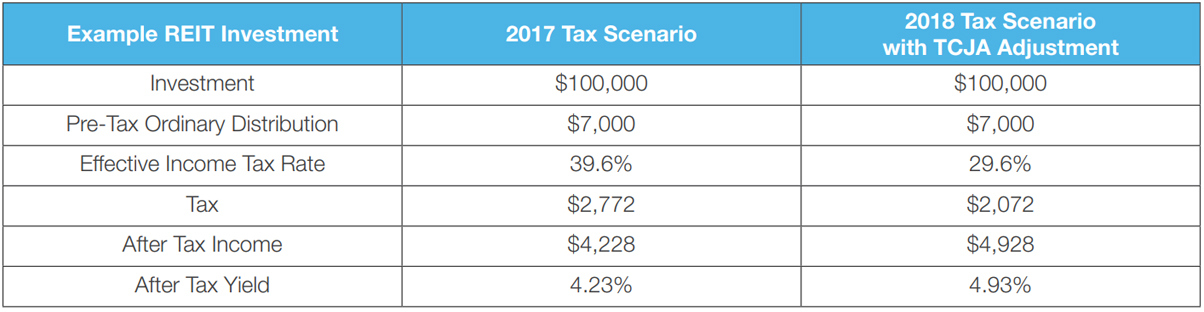

The Tax Cuts and Jobs Act TCJA provides a 20 deduction for pass-through. 710 if shareholder owns at least 10 of the REITs voting stock. Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios.

Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. That provides a slight reduction in tax rates while simultaneously amounting to an after-tax savings. Get your free copy of The Definitive Guide to Retirement Income.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. The majority of REIT dividends are ordinary income for tax purposes. In general the 20 percent maximum.

PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder. Ad With TurboTax On Your Side Get The Expert Tax Help You Need When You Need It. Ad Trade shares in commercial real estate without lockups no more holding periods.

This level is still above the. Analyze investments via suite of research tools offering property details data more. The tax law effectively lowered the federal tax rate on ordinary REIT dividends mortgage REITs included from 37 to 296 for a taxpayer in the highest bracket.

Join The Millions Who File Smarter.

The High Yield Potential From Reit Dividends Considering Taxes And Safety

How Tax Efficient Are Your Reits Seeking Alpha

Guide To Reits Reit Tax Advantages More

Reits In India Features Pros Cons Tax Implications

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Sec 199a And Subchapter M Rics Vs Reits

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

Taxation On Embassy Reit Dividend Stocks Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How To Pay No Tax On Your Dividend Income Retire By 40

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Reit Taxation A Canadian Guide

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law