fha gift funds cousin

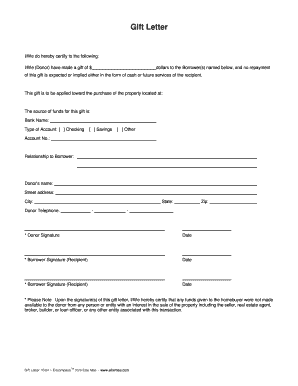

Gifts must be evidenced by a letter signed by the donor called a gift letter. However the FHA does allow for gifts from close friends and under those circumstances nieces nephews and cousins would qualify.

Gift Funds When Is A Gift A Gift According To Fha

The new FHA Policy changes limit seller.

. 41551 5B4b Who May Provide a Gift An outright gift of the cash investment is acceptable if the donor. George Souto NMLS 65149 is a Loan Officer who can assist you with all your FHA CHFA and Conventional mortgage needs in Connecticut. Pictures together will not show a clearly defined interest.

Use gift money to pay for the down payment and closing costs. This is much lower than a conventional mortgage loans requires. Seller Concessions and Reserves.

Indicate the donors name address telephone number and. The gift letter must. The 203 b and 203 k only require a 35 percent down payment.

The realtor can give you a gift if the realtor is your immediate family. The very long standing standard mortgage loan rules require gift money to be from a blood relative or a substantial person with a documented interest in the buyer. Nieces and nephews arent able to give your gift under normal family guidelines with an FHA loan the FHA does allow for gifts from close friends who have a clear interest in your life.

Its Never Been Easier. A gift can be provided by. Get Pre-Approved With MT Bank Today.

George can be contacted at 860 573-1308 or. Specify the date the funds were transferred. A relative defined as the borrowers spouse child or other dependent or by any other individual who is related to the borrower by blood marriage adoption or legal guardianship.

You can also get a gift from a legitimate. George resides in Middlesex County which includes Middletown Middlefield Durham Cromwell Portland Higganum Haddam East Haddam Chester Deep River and Essex. Ad FHA Home Loan Downpayments As Low As 35.

Complete Your Application Online In Minutes And Be On Your Way. The borrower isnt required to put any of his or her own funds when receiving a gift that takes care of the full down payment and closing costs unless the final loan amount is over. Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner.

The donor may not be or have any affiliation with the builder the. The FHA also allows gifts from an employer labor union or a charitable organization. A common example of this is a fiancee or boyfriend or girlfriend.

Your parents or immediate family. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. Heres who can give you a gift on an FHA loan.

This can include extended family. Gifts from these sources are considered inducements to purchase and must be subtracted from the sales price for mortgage calculation purposes. A fiancé fiancée or domestic partner.

FHA does allow gifts from approved charitable organizations government agency public entity and close friends who have a clearly defined and documented interest in the borrower. FHA defines this as. How to Use Gift Funds for Your FHA Mortgage in 2022.

For example Consider that the house you want to purchase cost. The portion of the gift not used to meet closing requirements may be counted as reserves. Close friend is very very difficult to document for underwriting.

Include the donors statement that no repayment is expected. Sellers Concessions-FHA mortgage requirements allow for seller concessions of up to 6 of the sales price. You dont mention who is the gifting person but it cant just be anyone.

The gifted funds must be sourced and seasoned and cannot be borrowed by the donor. FHA loans requires that borrowers who receive a Gift of Equity must have a minimum down payment of 35 percent of the homes final purchase price. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins.

In addition to the down payment requirement the borrower is also responsible for the closing and prepaid costs. A close friend with a clearly defined and documented interest in the borrower. Cousin including step and adopted In-laws including parents grandparents auntuncle brother- and sister-in-law.

Specify the dollar amount of the gift. To help cover the closing and prepaid charges the home seller is allowed not. But even a 35 percent down payment is a struggle for some buyers.

40 Fha Gift Letter Template Markmeckler Template Design Letter Templates Letter Gifts Letter Sample

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Gift Funds Definition And Guidelines Rocket Mortgage

Fha Loan Rules For Down Payment Gift Funds

Mortgage Down Payment Gift Rules Who What Why A Letter

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Qualify For A Jumbo Loan How To Use Gift Funds For A Down Payment

Fha Gift Letter Template Pleasant In Order To My Own Web Site With This Time Period I Ll Explain To You I Letter Gifts Letter Template Word Letter Templates

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Down Payment And Gift Rules Still Apply

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Letter Example

Fha Gift Funds How Can I Use Them To Buy A Home

Gift Letter For Mortgage Loan Fill Online Printable Fillable Blank Pdffiller

Children Are The Most Important Work C S By Handwrittenword 5 00 Words Inspirational Quotes Great Quotes

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Guidelines On Gift Funds For Down Payment And Closing Costs